This means that taxes are paid at the individual level. Income or losses from the business is “passed-through” to its members and reported on their income tax returns. LLC’s do not pay the taxes at the level of business entities. Illegal acts and certain commissions of negligence on the part of the owner can lead to the cancellation of this protection in some instances. This means that the owner’s assets cannot be pursued by the claimants of the LLC’s liabilities.īut this immunity has its limits. This includes debts, liens, mortgages, and lawsuits. In an LLC set-up, liabilities incurred by the business can only be charged upon the assets of the business itself. In this guide, we will explain some of the benefits and importance of an LLC setup.

It provides owners with liability protection, tax leverages, and management flexibility. Setting up a limited liability company (LLC) set-up is considered a best practice in risk management. A company may be executing its strategy to the letter but could still fail due to weak risk management. Most experts believe that success in business does not entirely rely on the objectives, programs, projects, and activities that management lines up. Despite the available information, technology, and countless references about starting a company, most entrepreneurs still encounter failures when starting their companies. This will improve your chances to produce a better outcome by providing your customers with good service while earning an equitable profit. This allows you to organize your resources according to their intended function. We harvest our data from various publically available data sources such as edgar database (SEC), form 5500 dataset (IRS), form 990 datasets (tax-exempt organizations) etc.With the advent of democratized tools and despite the current pandemic in the backdrop, Financial Times reports a boom in entrepreneurship and new companies being set up around the world.īefore you go any further and make necessary commitments investing in setting up your business, it is best to consider the different business types and find the most suitable for your setup to avoid being included in the 90% of startups that usually fail within their first year. We have a database of over 7.3M entities which can be searched to find the ein number of business entities.

#Ein number for teamfocus free#

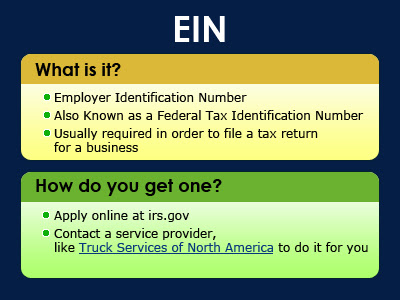

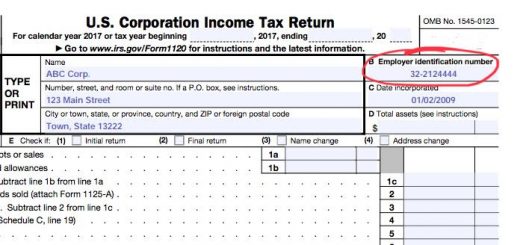

What is ?: Our website is a free resource to find the ein number for various business entities. Since all corporations - including ones with no income - must file at least a federal income tax return, a corporation operating or incorporated in the United States generally must obtain an EIN anyway either before or after being issued its charter. Also, financial institutions such as banks, credit unions, and brokerage houses will not open an account for a corporation without an EIN. To be considered a Partnership, LLC, Corporation, S Corporation, Non-profit, etc. Other commonly used terms for EIN are Taxpayer Id, IRS Number, Tax Id, Taxpayer Identification Number (TIN) etc.Ī business needs an EIN in order to pay employees and to file business tax returns.

The key management personnel include directors, officers, chairman, president etc.Įmployer Identification Number (EIN): The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number (FTIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) (format: XX-XXXXXXXXX) to business entities operating in the United States for the purposes of identification and employment tax reporting. The key management personnel for Team Focus Insurance Group, Llc are listed below. Registered agent is a business or individual designated to receive important communication like legal notice or summons and important paperwork sent by state for periodic renewal of the business entity's charter (if required).

The registered agent for Team Focus Insurance Group, Llc is Elkin Steven C. The florida registered agent for Team Focus Insurance Group, Llc is Elkin Steven C.ġ300 Sawgrass Corporate Parkway, Suite 300, The corporation type for Team Focus Insurance Group, Llc is Florida Limited Liability Co. Team Focus Insurance Group, Llc is incorporated in Florida and the latest report filing was done in 2020. EIN for organizations is sometimes also referred to as taxpayer identification number (TIN) or FEIN or simply IRS Number. The employer identification number (EIN) for Team Focus Insurance Group, Llc is 651062206. Team Focus Insurance Group, Llc is a corporation in Sunrise, Florida.

0 kommentar(er)

0 kommentar(er)